CEO Lisa Winton Testifies Before the House Ways & Means Committee Field Hearing on the State of the American Economy: The South

April 21, 2023

Chairman Smith, Ranking Member Neal, and distinguished members of the committee. Thank you for the opportunity to appear before you and for holding today’s hearing on the state of the American economy. As the leader of a family-owned small business right here in Georgia, I welcome you to the Peach State and look forward to discussing the challenges and opportunities facing manufacturers.

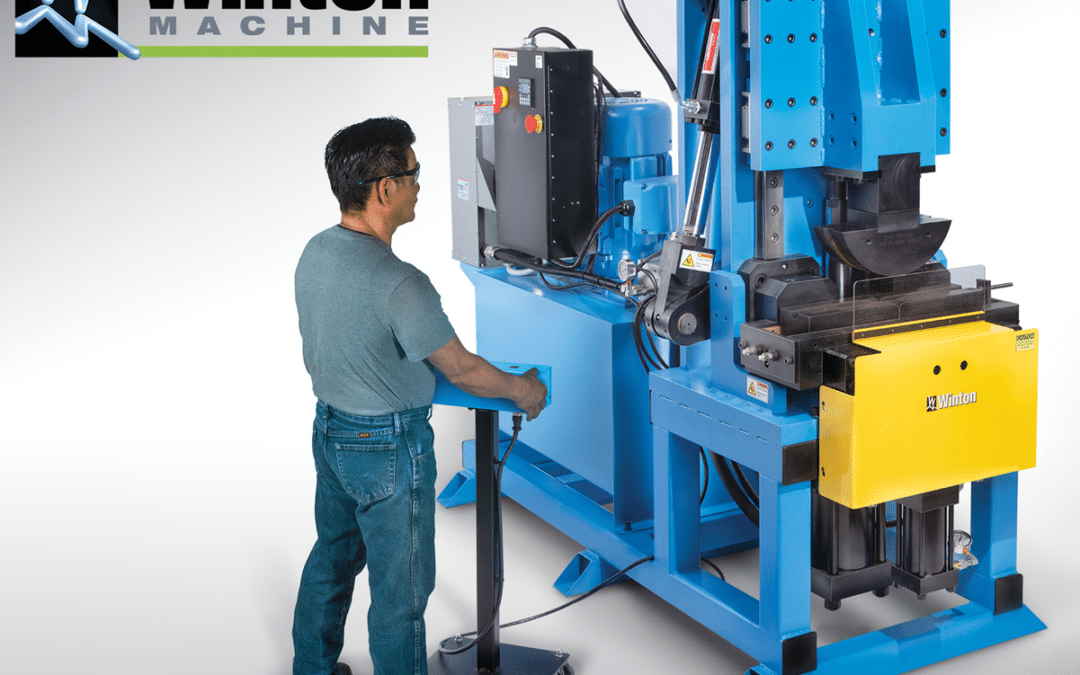

My name is Lisa Winton, and I am the CEO of Winton Machine Company. I am one of the nearly 244,000 small manufacturers in America. My company designs and manufactures machines that allow our customers to fabricate tubular parts and coaxial cable assemblies for their own products. Our solutions are incorporated into everything from refrigerators to the Mars Rover to the Iron Dome Weapons system that is used to protect Israel. All our design and manufacturing work is performed by our 38-person company and takes place in Suwanee, Georgia. That includes the development of proprietary software that is used exclusively on our products.

Winton Machine Company is the American dream. My husband and I started our company 26 years ago in our home. We turned our basement into a machine shop and our garage into an assembly area—and used our house as the office. Our first machine was built for a fellow manufacturer in Macon, GA to bend patented seat posts and over the years have grown both our product line and our customer base, moving to larger facilities six times as our business has grown. Today, we serve the HVAC, Refrigeration, Recreation, Lawn & Garden, Construction, Medical, Agriculture, Space Exploration, Furniture, Aerospace, Defense, After Market Automotive, and many more Industries.

Like many leaders in the industry, I am active in my community, I treat my employees fairly and I believe that anything is possible in America. And I know that when manufacturing is strong, America is strong.

A competitive tax system is important to manufacturers. Tax reform set the stage for manufacturing growth. In the year following the passage of the Tax Cuts and Jobs Act, Winton Machine saw a 49% increase in sales and a 53% increase in machinery shipments; we increased our engineering payroll by 65%, grew our overall labor payroll by nearly 150% and purchased a new, American-made CNC machine. We also saw the positive impact that tax reform had on other manufacturers. My company secured a new customer that accounted for 20% of our annual revenue. Their ability to buy our machines was based largely on their reduced tax burden. I’ve heard similar stories throughout the industry. As the National Association of Manufacturers has noted:

Manufacturers’ optimism reached record highs following tax reform’s passage in 2017, and this optimism has translated into action. 2018 was the best year for manufacturing job creation in the previous 21 years and the best year for manufacturing wage growth in the previous 15. Manufacturing capital spending grew 4.5% and 5.7% in 2018 and 2019, respectively.[1]

Our industry kept our promises to hire new workers, raise wages and benefits and invest in our communities. At Winton Machine, we invested $1.2 million into making our business stronger with new systems and machines, which included $300,000 in R&D just to develop the necessary software. These investments set the stage for the growth we have experienced.

Today, my company faces a variety of challenges. Our overhead costs have increased overall by 20% because of inflation. The supply chain challenges continue as inflation has taken its toll. A hydraulic power supply costing $10,000 is now $18,000. Lending costs have skyrocketed for ourselves and our customers, and while I would like to double the size of my facility, the cost to do so has risen fourfold over the last several years.

A recent industry survey detailed many of the challenges facing manufacturers. A shortage of skilled labor, rising prices and supply chain issues are front of mind for many.[2] And I would like to draw your attention to a specific finding from the report: More than 90% of respondents said that a higher tax burden on manufacturing income would make it even more difficult to hire more workers, invest in new equipment or otherwise grow their businesses. The tax system directly affects our ability to make things in America and effectively compete.

Winton Machine’s success is underpinned by our commitment to developing cutting-edge products and our customers’ ability to invest in best-in-class machinery. Unfortunately, three recent changes to the tax code make these activities more difficult and directly threaten the growth of manufacturing in the United States. After all, small manufacturers are operating in a difficult environment. When prices are rising, skilled workers are scarce and lending is costly, every additional dollar spent on taxes means that something must be cut.

The Tax Code Must Support Capital Investments

As I noted, my company designs and manufactures machines that are used by our customers to make their products. Many of my customers, and particularly our small business customers, simply don’t have cash on hand to buy new machinery, so they must find ways to finance their purchases. This often includes borrowing from banks, which has recently become more expensive given rising interest rates. As debt financing becomes more costly, their ability to purchase from Winton Machine becomes more difficult. Like our customers, our workforce is aging, and the new manufacturing talent wants automation. Winton’s own financing costs have similarly risen in recent years as we are working to retool our manufacturing facility.

A recent change to the tax code has made it even more costly to finance large equipment purchases. At the beginning of 2022, the deduction for interest on business loans was reduced in a manner that disproportionately affects manufacturers. The maximum deduction allowed under Section 163(j) of the tax code was narrowed from 30% of earnings before interest, tax, depreciation, and amortization (EBITDA) to 30% of earnings before interest and tax (EBIT).

Depreciation and amortization flow from investments in long-lived assets like equipment and machinery. Excluding those amounts from the base on which interest deductions are calculated harms firms in my industry. In practice, this means manufacturers that buy capital assets—like the machines my company produces—face higher after-tax costs when they borrow funds to make these purchases. As a result, the EBIT standard is effectively a tax on investment that makes it harder for manufacturers throughout the supply chain to grow.

Additionally, the United States has the unenviable distinction of being the only advanced economy with this policy, and the harm to American competitiveness is quantifiable. According to a recent study, keeping the EBIT standard could cost the U.S. economy 467,000 jobs and reduce U.S. GDP by $43.8 billion.[3]

It is critical that Congress reverse this policy that disproportionately impacts manufacturers, and I was pleased to see the recent introduction of the American Investment in Manufacturing (AIM) Act. Thank you to Congressmen Adrian Smith and Joe Morelle for leading this legislation. I urge the Committee to quickly approve it.

Another key tax provision affecting the cost of capital investments is “full expensing” or “bonus depreciation,” which began phasing out this year. Under this policy, companies could immediately deduct the full cost of a purchased machine. Without it, a buyer must take small deductions over many years. Allowing a full, immediate deduction can make an equipment purchase more affordable. I am fearful that the elimination of this expensing will force our customers to choose to continue to use older pieces of equipment longer rather than purchasing newer ones or buy less expensive Asian equipment. It’s difficult enough for an American manufacturer to compete with less expensive imports where their countries create unlevel playing fields. New equipment designed and manufactured here in America creates jobs here at home and drives American innovation. New State-of-the-Art equipment ensures workers are working as efficiently and safely as possible and powers job-creating growth.

Unfortunately, the 100% deduction level declined to 80% at the beginning of this year and will be completely eliminated by 2027. This will disproportionately harm manufacturers. As the Joint Committee on Taxation recently noted, manufacturers lead all sectors in the use of bonus depreciation. Manufacturing requires hard work, dedication, ingenuity, creativity—and machinery! Making those machines more expensive will be an impediment to growth.

I’d like to thank Congressman Arrington and the many members of the Committee who joined him in introducing the Accelerate Long-Term Investment Growth Now (ALIGN) Act. This important bill would make full expensing permanent, providing much-needed tax-planning certainty for manufacturers in the future. I hope that the Committee approves the legislation as soon as possible.

The Tax Code Should Encourage Innovation and the Development of Lifechanging Products

As an industry, manufacturers drive more innovation than any other sector. Manufacturing conducts more than half of all private-sector R&D in America, spending nearly $350 billion on research in 2021. This investment results in new products, materials and processes that make life better here and around the world.

Innovation allows my company to succeed in the marketplace. To keep up with our European competitors we need to constantly invest in improving our existing product line and create new products and solutions to respond to our customers’ evolving needs. Our company provides engineered solutions for semi-rigid coax and tube fabrication. As our customers develop new technologies for more efficient refrigeration or design new items for space exploration, for example, Winton Machine designs and builds factory automation to allow them to efficiently make these new products. We invest in R&D through new software, design, tooling, systems, and new equipment to meet their demands. And we are building the talent pipeline needed to make these new products a reality.

Despite the importance of R&D, a recent change to the tax code makes it more expensive to perform research. For decades, taxpayers have been allowed to immediately deduct 100% of their R&D expenses in the year they are incurred. But in 2022 the tax code began requiring so-called amortization of these amounts. Instead of a full deduction when research activities are performed, manufacturers are now only allowed to recover a small portion of their costs each year. This change means that companies investing in R&D will see their tax bills increase.

For Winton, that change will have a huge impact. Every dollar is critical because of the size of our company. Taxing our investments in mission-critical R&D means that we will have less funds to invest in our workers and the future growth of our company.

While America is using its tax code to make research more expensive, other countries are moving in the opposite direction. Belgium is the only other developed nation that has an amortization requirement for R&D. Meanwhile, China now allows a “super deduction” for manufacturing R&D that is equal to 200% of research costs. That is what we are up against.

By adopting the amortization requirement, the tax code makes it more difficult to undertake R&D activities in the United States. That will hurt our country. Recent research indicates that a failure to reverse this policy will cause the United States to lose 263,382 jobs and experience a GDP reduction of $82.39 billion in 2023, with the manufacturing industry projected to lose nearly 60,000 jobs.[4]

I was pleased to see the recent introduction of the American Innovation and R&D Competitiveness Act, bipartisan legislation that would reverse this harmful tax policy. Thank you, Congressmen Estes, Larson and other members of the Committee, for introducing this important bill. I urge the Committee to pass this legislation as quickly as possible.

Protect Family-Owned Manufacturers from Looming Tax Hikes

The issues I raised above are current challenges for manufacturers. Harmful changes affecting capital equipment purchases and R&D have already taken effect. But there are more damaging tax changes on the horizon that affect small manufacturers around the country.

Winton Machine is organized as an S corporation. Currently, pass-through entities (including partnerships, S corporations and sole proprietorships) are eligible for a 20% deduction on their business income. Pass-through owners see their business income reflected on their personal tax returns. This deduction reduces the amount of pass-through income subject to tax and allows small business owners to reinvest in their companies and their people.

This deduction is scheduled to expire at the end of 2025. At the same time, income tax rates for individuals – the rate at which earnings of pass-throughs like Winton Machine are taxed – are slated to increase across the board. Combined, these two scheduled changes will significantly, and suddenly, increase the tax burden on small manufacturers like us. That would make it more difficult for manufacturers organized as pass-throughs to invest in growth. Our profit is what we use to invest in hiring new employees, employee training, bonuses, new equipment, and systems, community donations and support and so much more. These impending tax changes will make growth stagnant.

In addition, scheduled changes to the estate tax could make it difficult to pass family-owned businesses on to the next generation. Manufacturers are uniquely impacted by the estate tax because so much of our business consists of machinery, equipment, and intellectual property. These assets are inherently illiquid. As a result, paying the estate tax could require selling off part of the business or taking on large amounts of debt. Either action can put the very survival of the family’s business in jeopardy. As a 1st generation business creator, I love to visit multi-generational businesses and learn how the company has grown over the generations.

The federal estate tax exemption was temporarily increased in 2017, but this increase is set to expire in 2026. If the exemption is reduced, more family businesses could be affected. In addition, some proposed modifications to the tax treatment of transfers at death (such as the elimination of stepped-up basis) would make it even more difficult for the next generation to keep a business going and keep people employed.

Succession planning is critical to keeping a family-owned small business running over multiple generations. The tax code should not make it more difficult to pass a business to the next generation of leaders. I urge members of the Committee to protect pass-through entities and family-owned businesses from these looming tax increases.

****

Thank you again for the opportunity to appear before the committee today. I am pleased to share my views and look forward to taking your questions.

[1] National Association of Manufacturers, Competing to Win (Sept. 2022) available at https://documents.nam.org/COMM/Competing_to_Win_2022.pdf.

[2] National Association of Manufacturers, Outlook Survey – First Quarter 2023, (Mar. 27, 2023) available at https://www.nam.org/wp-content/uploads/2023/03/Manufacturers_Outlook_Survey_March_2023.pdf.

[3] Economic Impact of Not Addressing the More Stringent 163(j) Interest Expense Limitation, EY (September 2022). Available at https://documents.nam.org/tax/nam_interest_deductibility_study.pdf.

[4] New Data: Taxing R&D Will Cost U.S. More Than 260,000 Jobs Next Year If Congress Doesn’t Act, National Association of Manufacturers (Dec. 16, 2022). Available at https://www.nam.org/new-data-taxing-rd-will-cost-u-smore-than-260000-jobs-next-year-if-congress-doesnt-act-19948/.